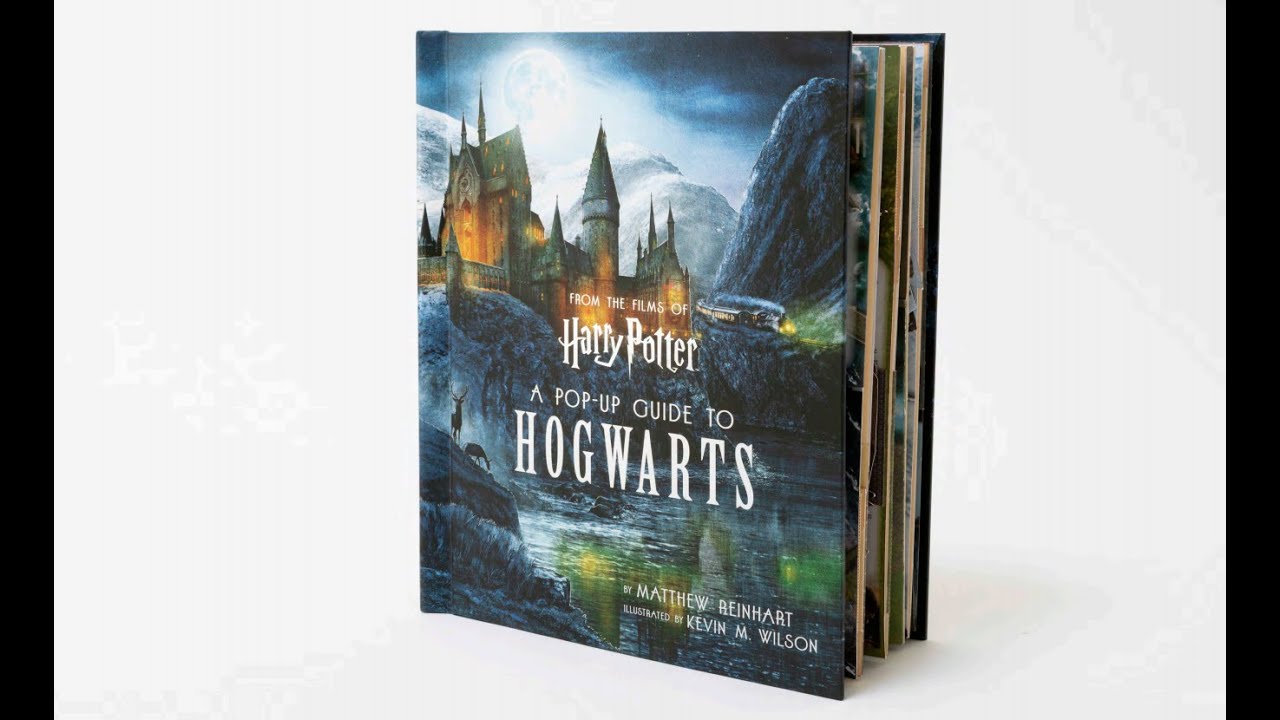

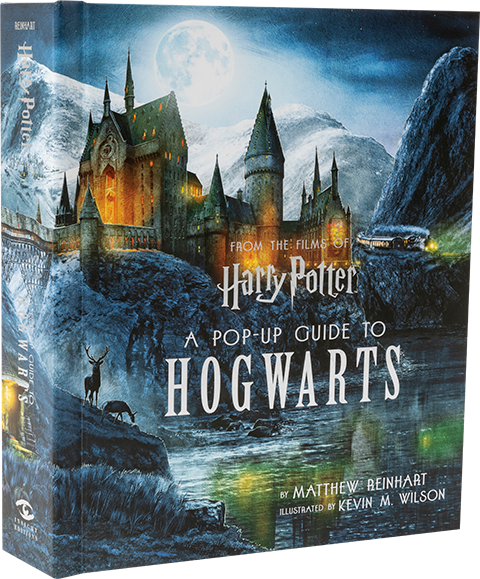

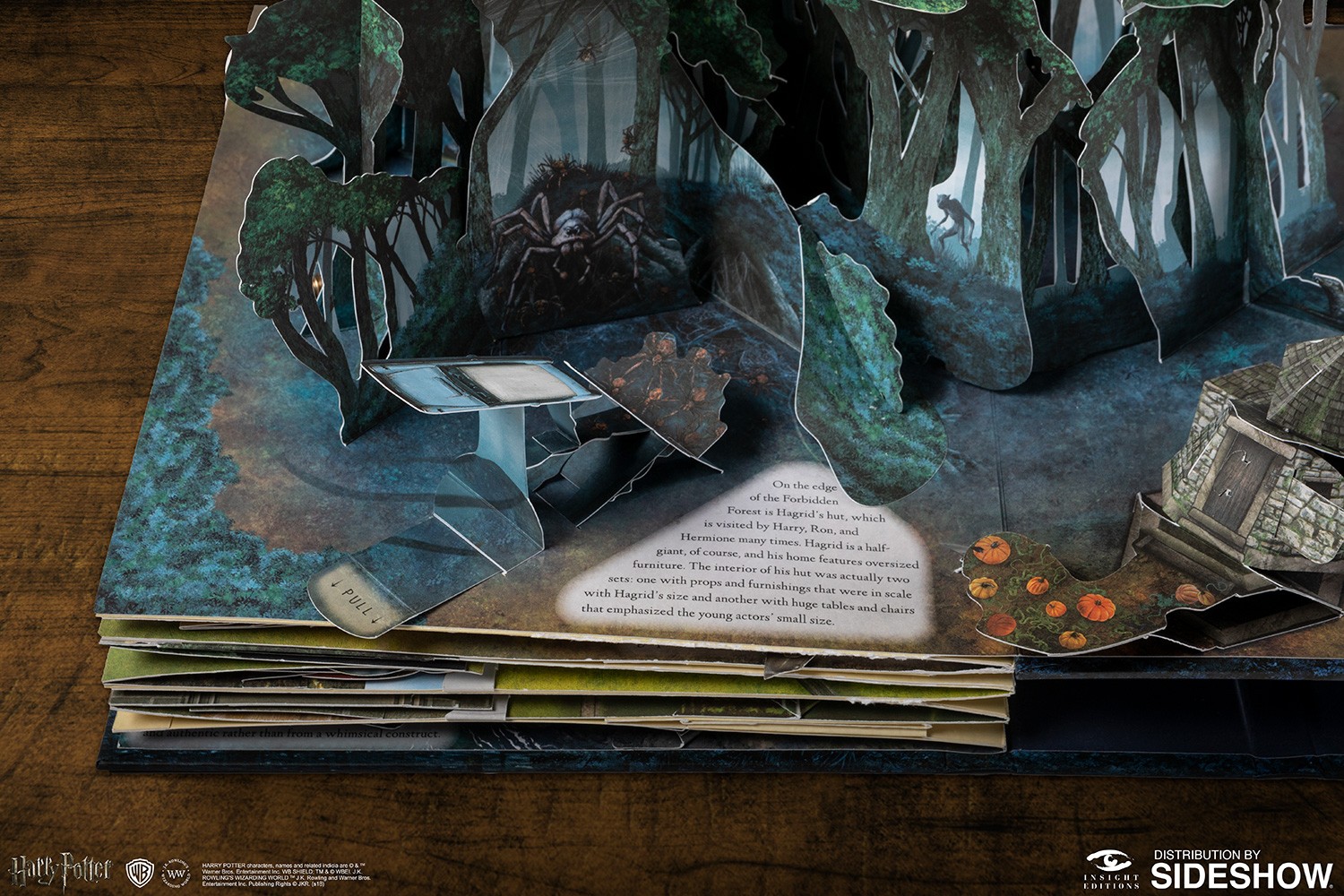

Harry Potter: A Pop-Up Guide to Hogwarts by Matthew Reinhart, Kevin M. Wilson, Hardcover | Barnes & Noble®

Harry Potter: A Pop-Up Guide to Hogwarts: Reinhart, Matthew, Wilson, Kevin: 9781683834076: Amazon.com: Books

Harry Potter A Pop-Up Guide to Hogwarts Hardcover Book Only $24.79 Shipped on Amazon (Regularly $75) | Hip2Save

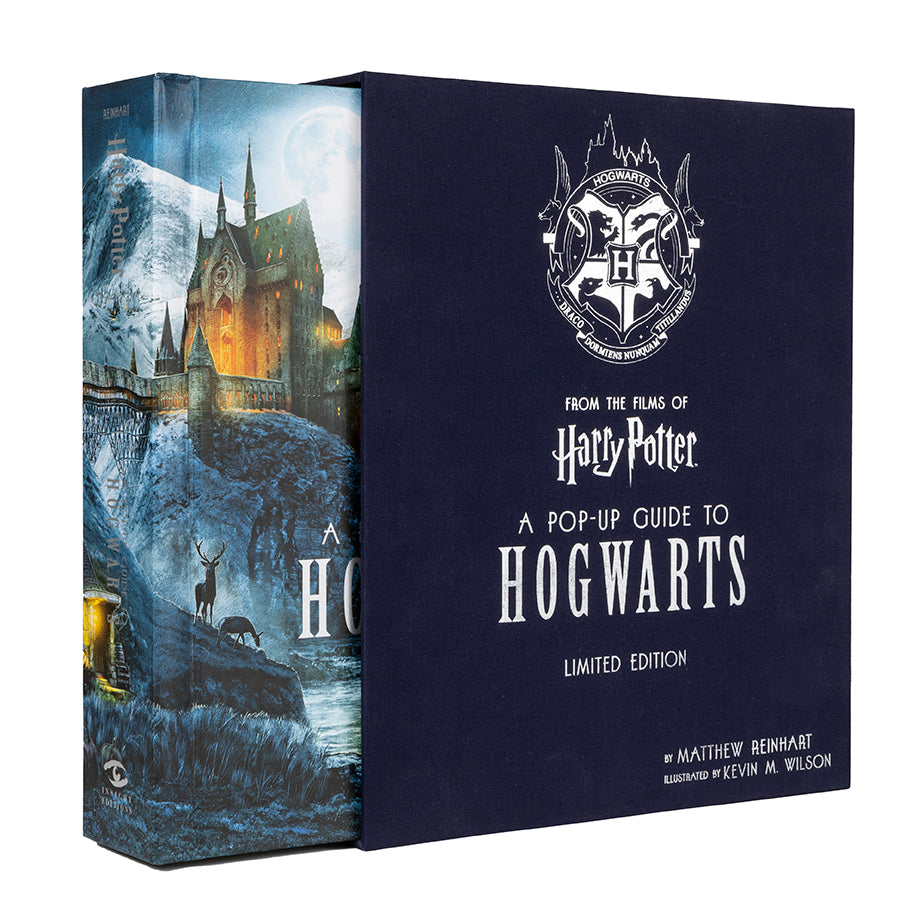

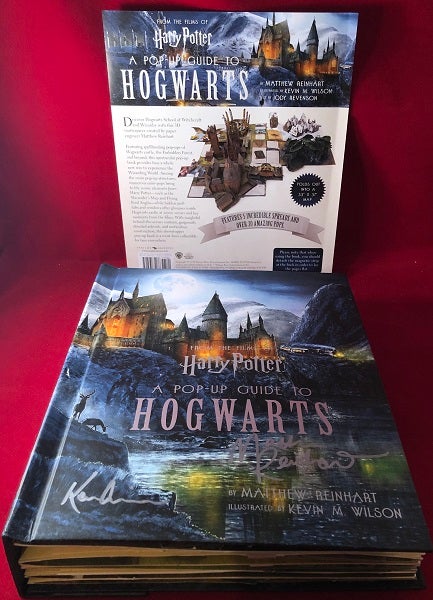

A Pop-Up Guide to Hogwarts: From the Films of Harry Potter SIGNED BY REINHART & WILSON | Matthew REINHART | First Edition

Harry Potter: A Pop-Up Guide to Hogwarts: Reinhart, Matthew, Wilson, Kevin: 9781683834076: Amazon.com: Books