Galano GA20 Kinderfahrrad 18 Zoll 115 - 130 cm Mädchen Jungen Fahrrad ab 5 Jahre Mountainbike 7 Gänge MTB Hardtail Kinder Fahrrad | pentagonsports.de

,type=downsize,aspect=fit;Crop,size=(450,450),gravity=Center,allowExpansion;BackgroundColor,color=ffffff;UnsharpMask,gain=1.0,threshold=0.05;)

Galano GA20 Kinderfahrrad 18 Zoll 115 - 130 cm Mädchen Jungen Fahrrad ab 5 Jahre Mountainbike 7 Gänge MTB Hardtail Kinder Fahrrad online kaufen bei Netto

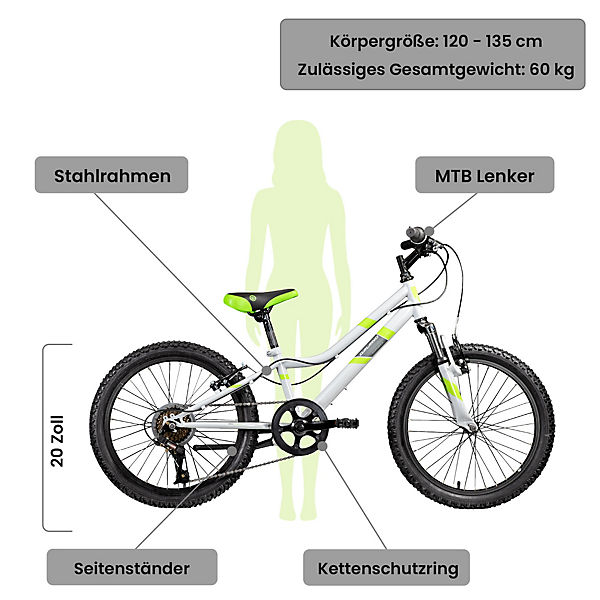

GA20 Kinderfahrrad 20 Zoll 120 - 135 cm Mädchen Jungen Fahrrad ab 5 Jahre Mountainbike 7 Gänge MTB Hardtail Kinder Fahrrad, Galano, grau | myToys

Hi5 Kinderfahrrad Polizei, 1 Gang, ohne Schaltung, Kinderfahrrad ab 5 Jahre Mädchen Jungen Fahrrad 115 - 130 cm Kinder

BIKESTAR Kinderfahrrad für Mädchen und Jungen ab 4-5 Jahre | 16 Zoll Kinderrad Classic | Fahrrad für Kinder Grün | Risikofrei Testen : Amazon.de: Sport & Freizeit

,type=downsize,aspect=fit;Crop,size=(450,450),gravity=Center,allowExpansion;BackgroundColor,color=ffffff;UnsharpMask,gain=1.0,threshold=0.05;)

Galano GA20 Kinderfahrrad 18 Zoll 115 - 130 cm Mädchen Jungen Fahrrad ab 5 Jahre Mountainbike 7 Gänge MTB Hardtail Kinder Fahrrad online kaufen bei Netto

Hi5 Kinderfahrrad Racer, 1 Gang, ohne Schaltung, Kinderfahrrad ab 5 Jahre Fahrrad Mädchen Jungen 115 - 130 cm Kinderrad

Galano GA20 Kinderfahrrad 20 Zoll 120 - 135 cm Mädchen Jungen Fahrrad ab 5 Jahre Mountainbike 7 Gänge MTB Hardtail Kinder Fahrrad | pentagonsports.de

BIKESTAR Kinder Fahrrad Aluminium Mountainbike mit V-Bremse für Mädchen und Jungen ab 4-5 Jahre | 16 Zoll Kinderrad MTB | Blau & Grün : Amazon.de: Sport & Freizeit

HILAND Adler 12 Zoll Kinderfahrrad für Jungen 2+ Jahre mit Stützrädern, Handbremse und Rücktritt blau : Amazon.de: Sport & Freizeit

BIKESTAR Kinderfahrrad 16 Zoll für Mädchen und Jungen ab 4-5 Jahre | 16er Kinderrad Mountainbike | Fahrrad für Kinder Schwarz & Grün | Risikofrei Testen : Amazon.de: Sport & Freizeit