Cleyver Headsets und Konferenzlösungen | Onedirect.de - Headsets für Schnurlos-Telefone (DECT) | Onedirect.de

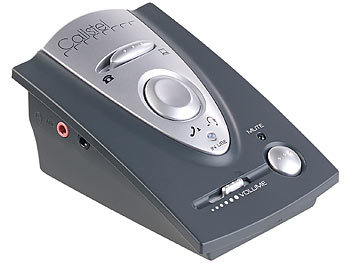

Callstel Telefonverstärker: Profi-Telefon-Headset inklusive Connector-Box für Festnetz-Telefone (Headset für Festnetztelefon)

Hama In-Ear-Headset für Schnurlose Telefone in Niedersachsen - Verden | eBay Kleinanzeigen ist jetzt Kleinanzeigen

2,5mm Schnurlos Telefon Headset Dual mit Noise Cancelling Mikrofon, Quick Disconnect, WANTEK Festnetztelefon Kopfhörer Telefonieren Headset für Gigaset C430 C610 S79H Panasonic Cisco Polycom: Amazon.de: Elektronik & Foto

2,5mm Headset Telefon Dect mit Mikrofon Noise Cancelling, Schnurlos Festnetz Kopfhörer Kompatibel mit Panasonic Gigaset C430A C530 S810 S850 CL660 Grandstream Cisco SPA Polycom, Kristallklar Chat: Amazon.de: Elektronik & Foto

ORIGINAL PLANTRONICS HEADSET schnurlose Telefone 2,5mm Klinkenstecker Kopfhörer EUR 99,99 - PicClick FR